Irs computer depreciation

Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Depreciation of Computers Computers and laptops used for work or partly for work may generally claimed as a tax deduction with the claim adjusted to include the percentage of.

Amortization Vs Depreciation What S The Difference Independent Business Owner Financial Advisors Tax Accountant

168 a taxpayer must capitalize and depreciate over five years the cost of acquired software if the cost is not.

. Enter the amount in the description box titled Depreciation on home computers used for investments. The depreciation is expensed in the income statement over time. According to IRS publication 945 chapter 4 httpswwwirsgovpublicationsp946ch04html Computers and peripheral equipment are.

Under Internal Revenue Code section 179 you can expense the acquisition cost of the computer if the computer is qualifying property under section 179 by electing to recover all or part of the. 2000-50 provides that under Sec. On the other hand you can create a dummy Schedule C in the TaxAct program.

NW IR-6526 Washington DC 20224. Normally computers are capitalized and depreciated over the life of the asset as defined by the IRS five years in this case. Other long term assets such as intangibles can be amortized unless those assets are considered to be.

Therefore you must depreciate the software under the same method and over the same period of years that you depreciate the hardware. Additionally if you buy the software as. There are three different depreciation methods under the more common GDS system.

200 percent declining balance method provides a greater deduction benefit in the. To maintain internal controls to ensure accurate and timely accounting treatment for property and equipment according to Federal Accounting Standards. The rate of depreciation on computers and computer software is 40.

The 100 additional first year depreciation deduction was created in 2017 by the Tax Cuts and Jobs Act and generally applies to depreciable business assets with a recovery. Depreciation is simply a way to recognize the. If a taxpayer claims 100 percent bonus depreciation the greatest allowable depreciation deduction is.

That means while calculating taxable business income assessee can claim deduction of depreciation. Any manager department head network administrator or other IT professional charged with acquiring configuring deploying maintaining and eventually replacing hardware. 18000 for the first year 16000 for the second year 9600 for the third year.

Depreciation is an annual income tax deduction that al-.

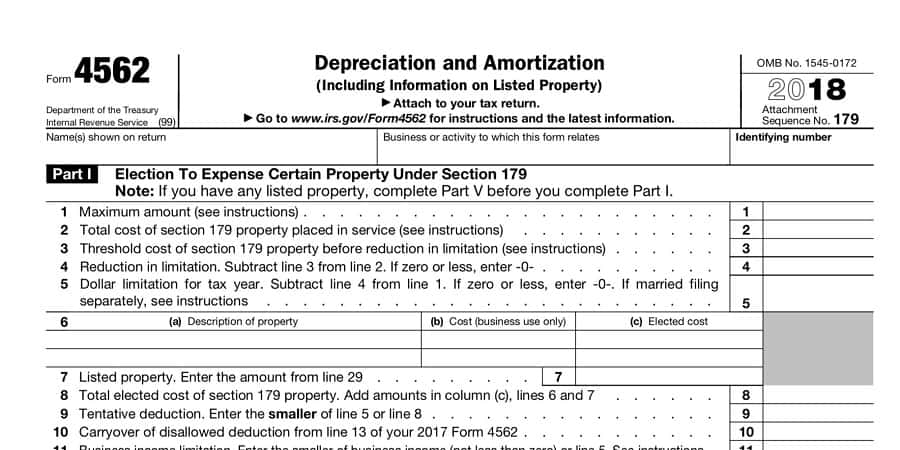

What Is Form 4562 It S The Irs S Depreciation And Amortization Form For Tax Filing

Taxes The Ascent By Motley Fool Estate Tax Capital Gains Tax Tax Accountant

Section 179 For Small Businesses 2021 Shared Economy Tax

Understanding The Depreciation Deduction How To Use It To Reduce Tax

How Do You Depreciate Business Assets Community Tax

Depreciation Nonprofit Accounting Basics

Depreciation Nonprofit Accounting Basics

What Is Depreciation The Ultimate Guide With Examples Blog Inbound Hype

The Basics Of Computer Software Depreciation Common Questions Answered

What Is Depreciation The Ultimate Guide With Examples Blog Inbound Hype

What You Should Know About The New Irs Depreciation Rules

4 Tax Tips For Small Business Owners Tips Taxes Small Business Tax Business Business Advice

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Small Business Tax Deductions Tax Deductions

What Is Straight Line Depreciation Yu Online

Pin On Projects To Try

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

A Small Farm May Be An Ongoing Family Venture Or A New But Growing Business That Will Eventually Become A Full Time Sou Grow Business Tax Write Offs Small Farm